Direct debit for accountants

Ezypay provides leading automated payment solutions for accountants to manage their recurring direct debit payments.

Frictionless payments for accountants

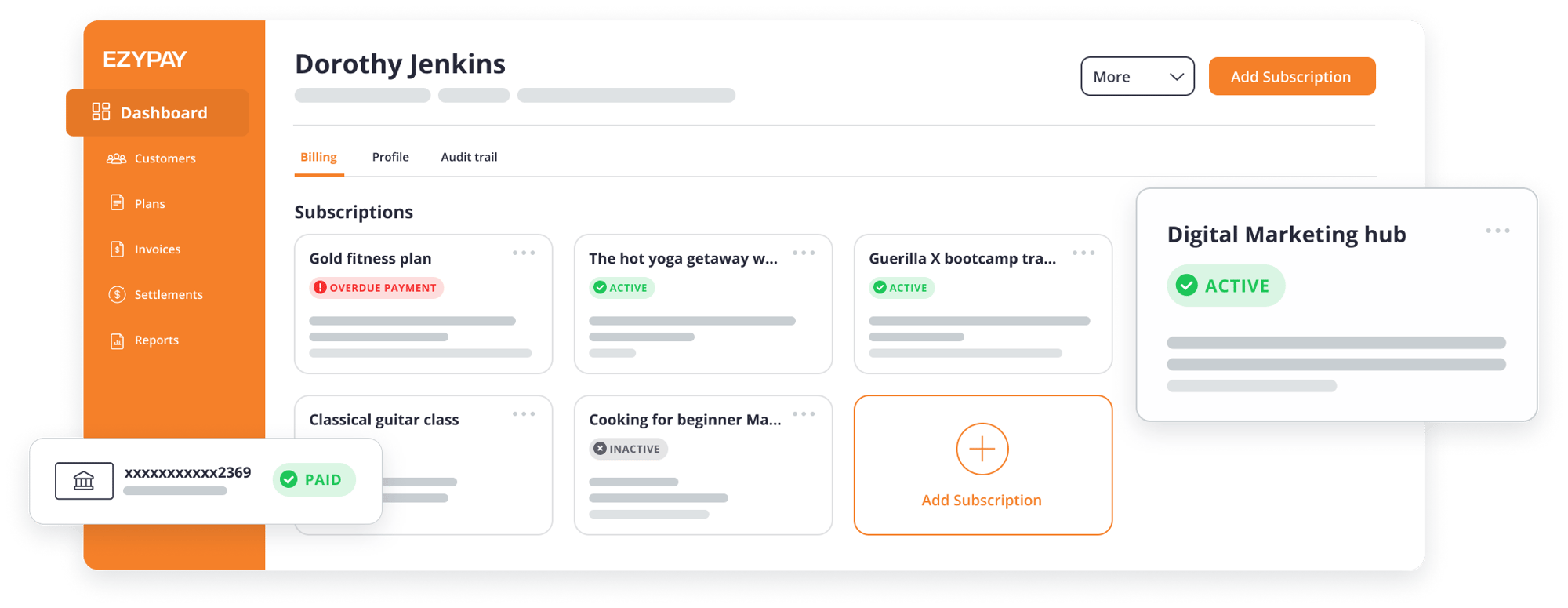

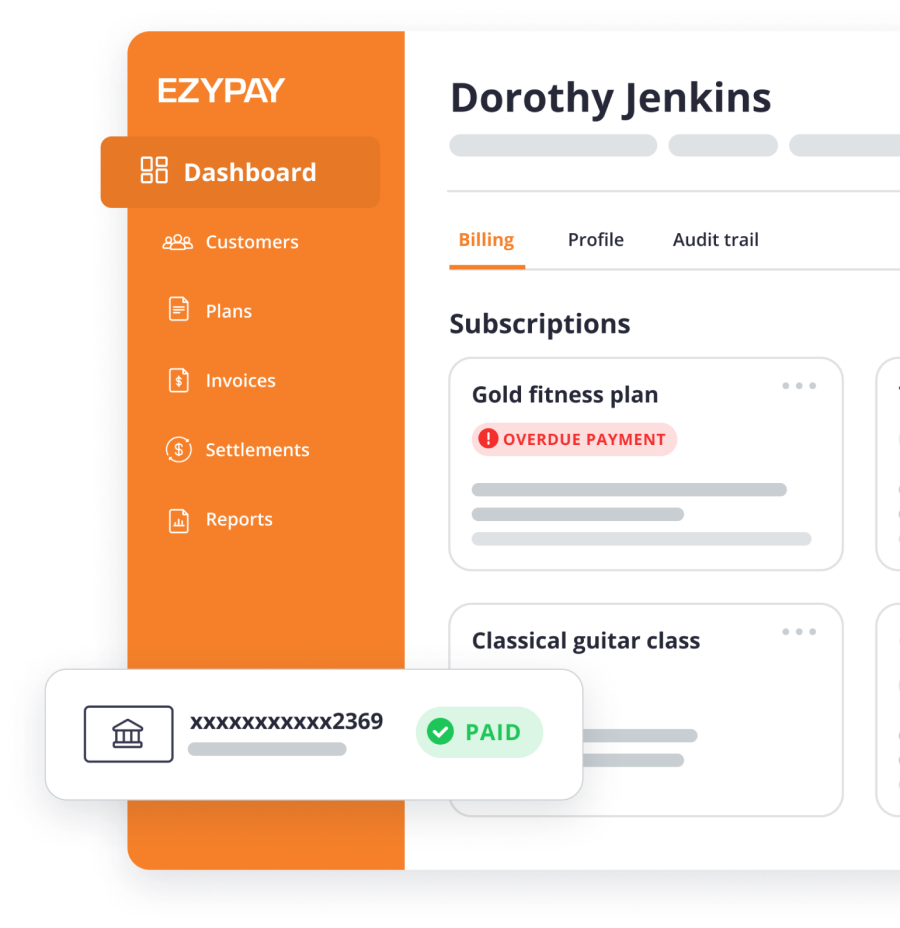

Ezypay’s advanced payments software maximises collection rates and provides a frictionless payment experience for accountants. Our stand-alone solution will help you spend less time on unnecessary administration and more time on your clients, whilst making services more affordable with payment plans.

Effortless payment processing

Automated and easy to use

Relieve staff of the manual duties around chasing clients for payment with direct debit for accountants. Easily create bespoke payment plans for your accounting business by setting direct debit instructions such as frequency of payments, amounts to be collected and payment methods. The platform enables paperless direct debits for accounting fee collection, as well as automatic failed payment handling, and automatic electronic payment reminders.

Provide payment options

Offer customers payment options with Ezypay direct debit for accountants. Ezypay accepts bank direct debits, debit card and credit card payments via Visa and MasterCard. Increase your revenue and cater to a wider group of customers by supporting multiple payment methods with Ezypay. Our responsive online forms work across multiple channels and devices.

Improve collection rates and cash flow

Maximise cash flow and get paid faster with regular, on-time and automated direct debit payment collection. Ezypay has a proven track record of collecting over 50% of failed payments that do not go through on the first attempt. We automatically notify and rebill customers and provide them with multiple payment options to resolve their payment.

Automated failed payment handling

No more wasting time, paper or manpower on collecting outstanding payments for your accounting business each week. When a payment fails, choose from automated re-billing to attempt the collection again 3-30 days after the payment fails, stop billing to allow you to manually handle the payment yourself, or continue billing as normal with the outstanding payment remaining.

Security and compliance

Our cloud platform is PCI DSS (Payment Card Industry Data Security Standard) accredited and is compliant with the relevant Australian and local country’s banking rules and regulations. Ezypay’s direct debit solution for accountants ensures all payments are made at the highest level of security. Make compliance our job, not yours.

Get started for free

There are no upfront costs to use Ezypay’s automated billing solutions and direct debit payments. There is no need to obtain merchant bank account to start accepting direct debit and credit card payments with us. It’s as simple as applying online and activating your account to begin exploring the potential for your martial arts centre. With Ezypay, it has never been easier to manage automating recurring direct debit payments for customer fee collections.

Insightful reporting capabilities

With Ezypay, generate up to nine financial reports and analyses built to answer the most frequent and crucial financial concerns and queries. Accountants can use these reports for seamless reconciliation and to inspect valuable data regarding monthly direct debits.

Want to learn more about Ezypay?

Simply fill in the form and our Payments Specialists will be in touch to discuss your needs and advise on the Ezypay features best suited to your accountancy firm. They can also answer any questions you may have to prepare your business for automated subscription billing.

Got a question about pricing?

All pricing plans include multi-site management on one account, cross border settlements which allows you to collect debit across different countries, multi-currency settlement (e.g. sell in NZD but collect in AUD), online payment plans and an online payment gateway to collect failed debits.

There is no minimum monthly transaction amount or value you must reach and fees can be paid by either the club or passed down to your parents or players.

Best of all there is no set-up fee or monthly fees to keep you going.

Your questions answered

Do you have a question about setting up an Ezypay account? We’re here to help. Browse through the most common FAQ or contact us directly to ask your own question.

Contact us

What fees does Ezypay charge?

Ezypay charges fees for loading clients onto a payment play (load fee) and transaction fees for each transaction. There is also a fee charged each time a payment fails known as a failed payment fee.

Fees can be paid by either the business or the client. Ezypay does not charge a monthly or ongoing fee to use our payment services

Can a client sign themselves up to a payment plan?

How quickly will I receive the money after it has been collected from my clients?

This depends on your chosen distribution cycle (i.e. weekly or monthly). Weekly distributions are collected from Saturday to Friday and funds are transferred into your business account on the following Wednesday.

If you prefer to have collected funds transferred on a monthly basis, monthly distributions collected throughout the month will be transferred into your account after 3 business days the following month.