Top tips to improve payment collection rates

- August 14, 2024 ⎯ 15 mins read

Do you own a business that offers subscription payment plans to your customers? Overdue invoices can be a costly and time-consuming problem especially when your business relies on a regular, consistent stream of income to cover essential costs - like wages and rent.

Luckily for you, there are some best practices that your company can follow to both improve payment collection rates and build additional revenue for your business.

Quick summary

- Your payment collection rate is an important metric that represents how successful your business is at collecting payments from your customers.

- Even a small increase in payment collection rates can improve your business’s cash flow and revenue potential.

- Working with a trusted payment facilitator like Ezypay can help your business improve its rates and generate more revenue.

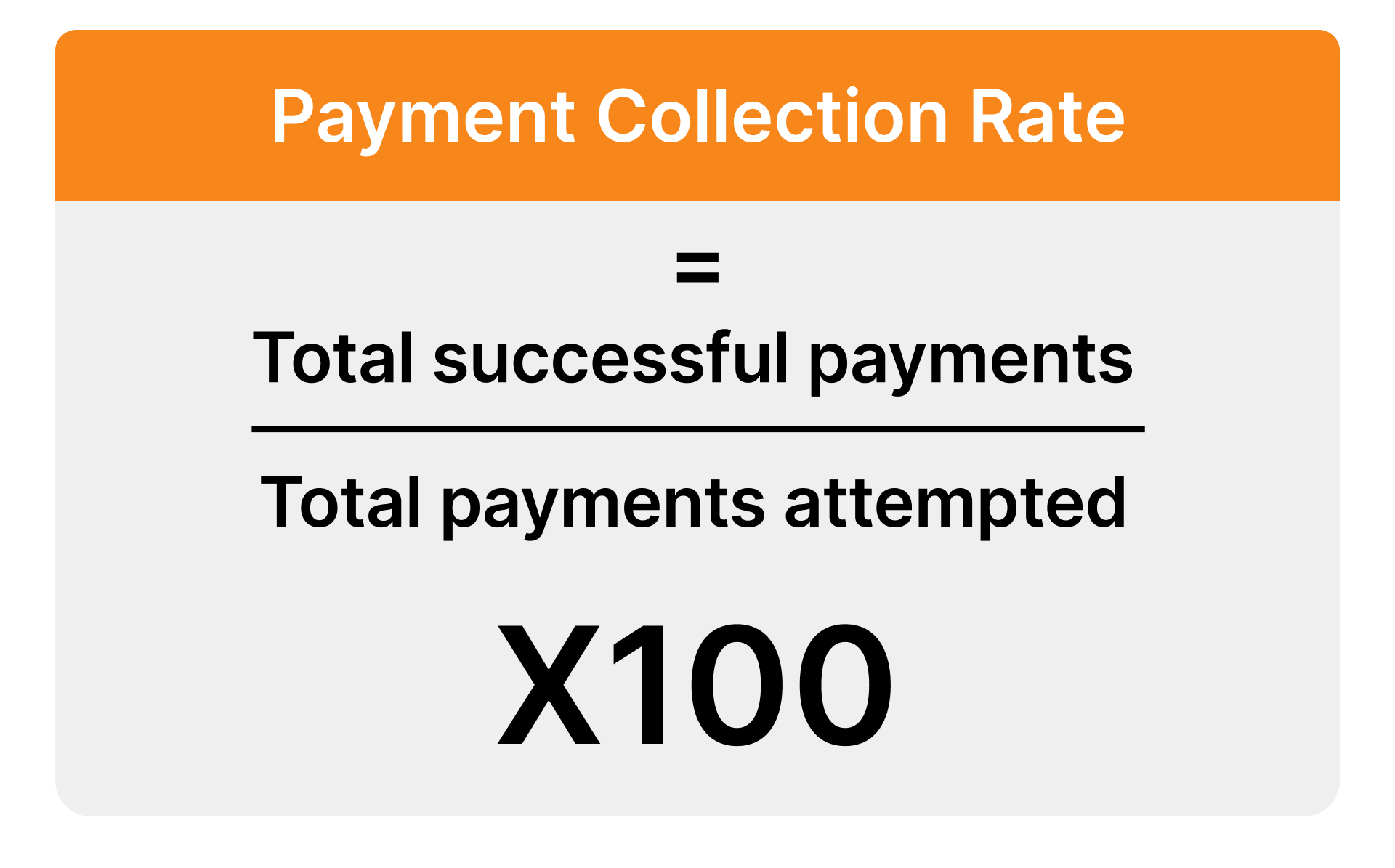

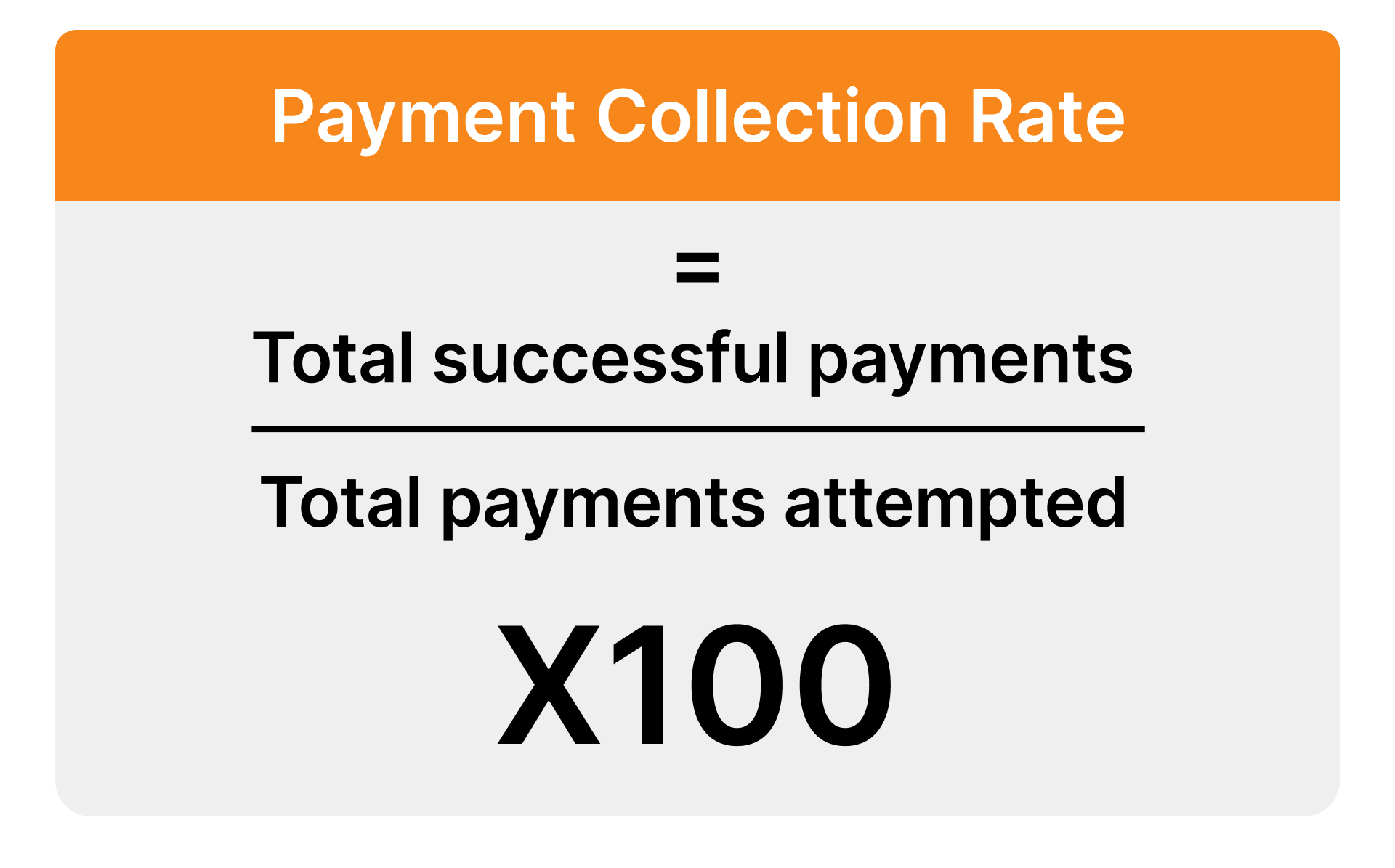

What are payment collection rates and why should I care?

A business’s ‘payment collection rate’ is a percentage of the total number of payments successfully captured, vs. the payments that were not captured. While at first this might seem like a simple metric, optimising your payment collection rates is one of the most important factors for steady business growth. It’s worth investing time and energy to optimise your payment collection processes as best you can.

Suppose you have 50 regular customers at your business and 30 of them paid for their fees by the end of the week. This means your business has a payment collection rate of approximately 60%.

In essence, your business has missed out on 40% of your expected revenue for this week – and, while this money can be recouped in a future billing cycle, it will not land in your account during this billing cycle, which could have flow-on effects. You might need to draw on reserve funds to pay your staff or cover the rent for your premises.

Of course, it’s important to keep a reserve of cash handy for moments like these to cover these costs and ensure your staff and suppliers are paid on time.

However, if you find a way to capture this remaining 40% of missing revenue every week, your business will see an increase of 67% in weekly revenue without growing your customer base.

How do collection rates impact my business?

As illustrated above, high payment collection rates are integral to the growth of any business. Improving your payment collection rates (even by a small amount) means you will see an increase in revenue for your business. After all, it’s impossible to reinvest money back into your business if you are constantly chasing your customers for last month’s fees.

Let’s demonstrate how improving payment collection rates for a gym or health club dramatically increases the revenue accrued by this gym every month.

When a multisite fitness franchise wrapped up its first year of business, it had successfully processed 39,747 invoices, while 3,131 payments had failed. This represents a payment collection rate of 92.7%.

After a year, this business had improved its collection rate by 1.3%, bringing the total collection rate to 94%; meaning they were now successfully capturing 40,305 invoices a year.

While initially, this might not seem like a massive improvement, consider that the average member pays $1300 per year for their gym membership fees. This means they raised an additional $14,000 a year in revenue – all without needing to increase gym membership fees to cover the costs of late payments or recruit new members.

How do I increase payment collection rates for my business?

The simplest way to improve your payment collection rate is to find and work with a trusted payment facilitator who offers the following features as a part of its service offering:

Automated failed payment handling

Automated failed payment handling describes processes that automatically roll out when a payment has failed to be collected. These processes are designed to improve payment collection rates for your business by rebilling failed payments automatically or prompting your customer to settle their late payments themselves. You may want to customise the failed payment handling approach for each customer depending on their lifecycle and previous billing activity.

Examples of this functionality include,

- Automated SMS or email messages with a ‘Pay Now’ link: this feature encourages your members to quickly settle the amount they owe to your business.

- Bespoke payment handling processes: depending on the customer, their lifecycle and their previous payment behaviour, your business might choose to rebill right away, pause billing or stop billing them entirely.

- Pre-debit notifications: pre-debit notifications are automatically sent to members before you attempt to bill their account. This forewarning allows your members sufficient time to ensure they have the money handy to cover their upcoming transactions.

Network tokenisation

Yet another important feature is network tokenisation. Network tokenisation is a form of payment card tokenisation, which replaces a customer’s primary account number (or PAN) with a unique token. The benefit of network tokenisation is that, even if a card is lost or stolen, the token can still be used to facilitate transactions, meaning your business can continue to bill customers even if they no longer have the same access to the same physical card details provided during onboarding.

Maximise your revenue by working with a payment facilitator like Ezypay

If you are brainstorming ways to improve payment collection rates for your business, consider working with a trusted payment facilitator like Ezypay. For the past quarter of a decade, the team at Ezypay have been helping companies improve their payment collection rates and revenue by utilising innovative techniques like network tokenisation, automated failed payment handling, pre-debit notifications and so on.

Ezypay has helped businesses in mature markets such as Australia and New Zealand, increase their payment collection rates by over 5% following the move from one payment facilitator to Ezypay. In less mature markets, the increase is even more dramatic, with some businesses seeing an additional 20-30% in payment collection rates.

Additionally, Ezypay’s payment collection rate outperforms the Australian industry standard of 90%, with an average collection rate of over 97%.

Because of this proven track record and consistently high payment collection rates, many businesses in APAC are turning to Ezypay to help them maximise their collection rates and revenue.

Ready to see how your business can improve its payment collection rates? See how Ezypay can help – get in touch today.