Transform your payment collection process with Ezypay

Discover how Ezypay can revolutionise your business operations with our advanced payment processing solutions.

Explore our payment collection processing platform

Automated Payments

Improve company cash flow and save time on administration.- Create bespoke payment plans to collect recurring and one-off payments automatically

- Reduce payments-related administration

Payments & Invoicing

Securely accept multiple payment methods and provide customer choice.- Accept Visa, Mastercard, American Express, bank accounts and PayTo (varies by country)

- Process international credit and debit cards

Failed Payment Handling

Maximise collections and recoup lost funds without manual intervention.- Recover more than 50% of payments that fail on the first attempt

- Send smart alerts to customers throughout the payment cycle

International Payments

Tap into payment experience across multiple countries in Asia Pacific.- Strong relationships with local banking partners

- Process a broad range of international currencies

- Access customer support locally

Customer Management

Simplify the online sign-up process and keep customers informed.- Convert prospects quickly using responsive forms

- Onboard new customers seamlessly

- Migrate from other payment providers

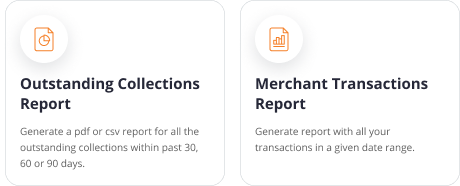

Reporting & Analytics

Generate a range of financial reports to make swift, informed decisions.- Automate and analyse a range of inbuilt financial reports

- Reconcile accounts effortlessly

- Integrate data with accounting software

Book your Personalised Consultation with a Recurring Payments Specialist

Simply choose a time on the calendar that’s convenient for you.

Our Recurring Payments Specialist will be in touch to discuss your needs and advise on the Ezypay features best suited for your business. They can also answer any questions you may have to prepare your business for automated subscription billing.

Customer success stories

"My business started using Ezypay about 20 years ago and I have encouraged other businesses to do the same. The system works very well. I find the fees very reasonable and the platform allows me to either consume the fees or pass them onto my client so from my perspective it is ideal for what we do and I can definitely recommend Ezypay to other businesses."

Nathan Miller

Managing Director, Smart On Hold

“Ezypay has taken the stress of accounts being paid on time away from me and my clients. It really is the easy way for my clients to pay."

Kaz Parrot

Director, Raising Connected Kids

"I use Ezypay for managing my customers' payment plans, which significantly reduces the administrative burden as a sole trader."

Kelly Ausmus Albornoz

Owner, Albatross Photography and Design

"Ezypay has helped my business grow and been the single most significant improvement I have made to my business since it began in 1993. It has helped streamline customer payments, rebills and delinquent payments, and is directly responsible for an increase in customer satisfaction and retention."

Geordie Lavers-McBain

Owner, Black Dragon Kai

Learn more about Ezypay

Ezypay Features

Ezypay makes it easier for your business to collect payments online.

Pricing Plan

Clear and upfront pricing for your subscription or on-off billing needs.

Getting Started

Set up your business account in a few easy steps to start collecting payments.